Legacy Gifts are for Everyone

Many times, when people hear the words “estate planning” or “legacy gift,” they think “I’m not rich – that doesn’t apply to me.” At the Foundation we know that simply is not true – legacy gifts of any amount are always welcomed and deeply appreciated. Leaving a “modest” amount (“I want to give $3,000 to my parish and the rest is for my family”) or “small” percentage (“5% of the value of my home should be donated to charity”) will still have a big impact on the organizations you love.

Blended Gifts

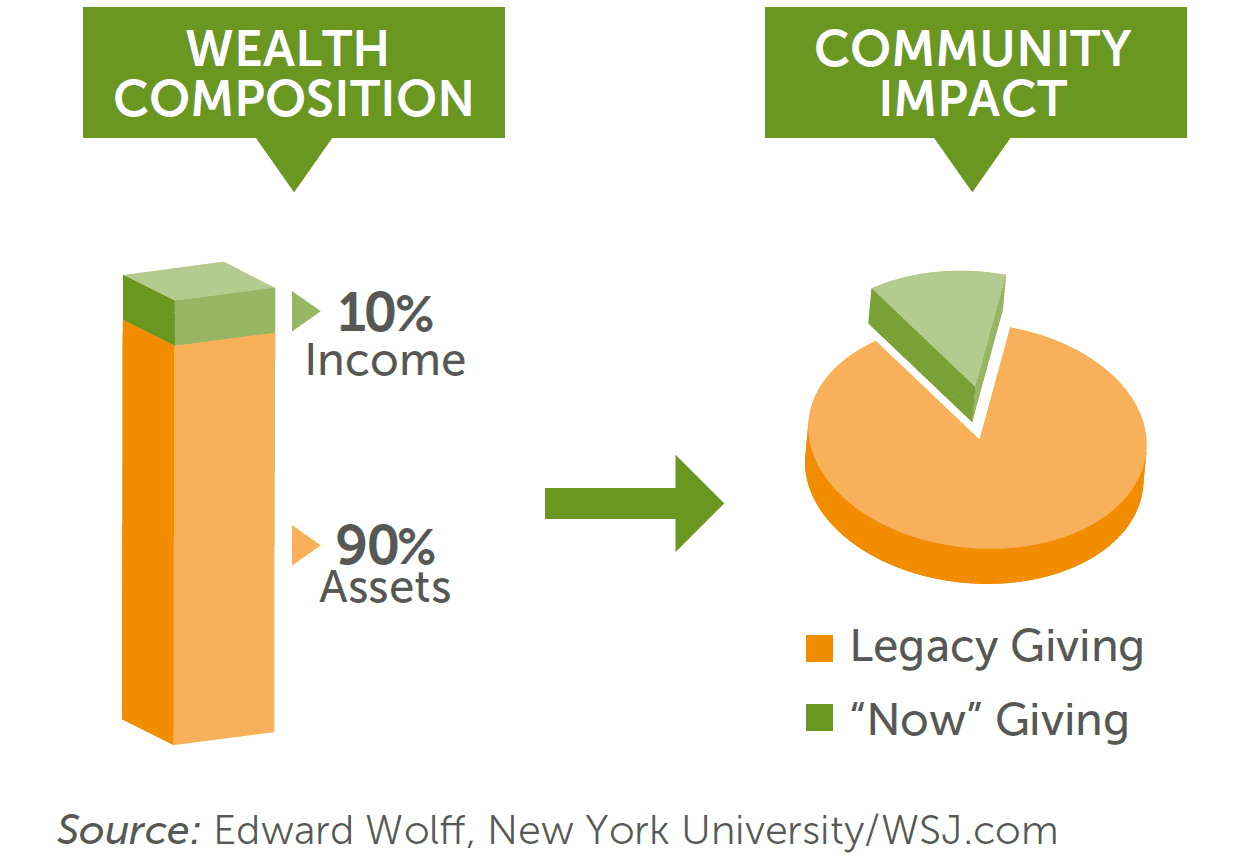

Current and legacy giving are not “either/or” decisions. Many people would like to give more to the causes they love today but are limited by the expenses of everyday life. For most people, the majority of one’s wealth is tied up in assets which is why legacy giving can bring great joy. Legacy Gifts come from the donor’s assets after their lifetime and are usually much larger than what that donor was able to give during their lifetime.

Legacy Giving and Endowments

An endowment is often the perfect recipient of a Legacy Gift. Endowments provide stable, permanent support for the organizations we love. By directing your Legacy Gift to an endowment, you can help support an organization you love FOREVER. Your gift will always remain a part of the endowment because the corpus of the fund is never spent – only the earnings are used for annual grants.

Types of Legacy Gifts

Create a lasting legacy that benefits of Catholic organizations and ministries you love by considering gifts that include:

Bequest

A bequest is gift from a will or trust and is one of the easiest gifts you can make to significantly impact the organizations you love.

Bequests of Specific Asset

The most comment asset left to charity is real estate.

Bequest of Specific Amount

Any dollar amount can create a meaningful gift!

Bequest of a Percent

Typically a percentage of your entire estate. The benefit of a percentage is that if your estate is ultimately larger or smaller than you originally anticipated, the gift will automatically be adjusted, as opposed to a set dollar amount.

Contingent Bequests

A bequest to charity can be the “backup” plan. Say, for example, you would like to leave all your assets to your sibling. However, in the event that your sibling dies before you, all of your assets would then go to the charity you name.

Bequests from Residual

The residual is what’s “left over” in your estate. You may have laid out a set of instructions for after you pass away, like paying off certain bills or allocating certain amounts to people. You can make a gift of the residual, which means that whatever is left after all your instructions are followed will go to charity.

Retirement Account

A retirement asset like an IRA account makes an excellent bequest to charity. If you leave the IRA to your family, much of the value could be depleted through taxes. By designating charity as the beneficiary of part or all of your IRA, the full value of the gift is transferred tax free at your death and your estate receives a charitable deduction.

If you wish to leave your IRA to your spouse, you may also designate charity as the secondary beneficiary of your account.

Contact your IRA or retirement account custodian to obtain a beneficiary designation form and make a bequest from your IRA.

Life Insurance Policy

If you have an unneeded life insurance policy, you can donate it and take an immediate tax deduction. You can also name a charity as a beneficiary of your policy. As an asset of your estate, an insurance policy may be taxed at your death. However, if the policy is gifted to charity, your estate avoids paying tax on the value of the policy and receives a deduction for the gift.

Contact your insurance company to obtain a beneficiary designation form and make a bequest of your policy.

Charitable Remainder Trust

A charitable donation that provides you a tax deduction and payments for life.

Benefits of a CRT:

- Income and estate tax deductions possible

- Lifetime or term income with percent limits or fixed amounts payout depending on the type of trust

- Income payments from the trust performance (may run out of money)

Sample Bequest Language

Would you like to include a legacy gift in your will or trust? Use this sample bequest language as a starting point and talk to your professional advisor about how to incorporate a bequest into your estate plan.

Questions?

Have questions about how to take the next steps toward leaving a legacy gift? Please reach out at 408.995.5219 or click the button below!

This information is not intended as tax, legal or financial advice. Consult your personal advisors for information specific to your situation.