Congratulations on your new Donor Advised Fund!

Scroll to learn more about how DAFs work and the value of working with the Foundation as your partner in philanthropy.

↓ Click for more information about Donor Advised Funds (DAFs) ↓

Questions?

What is a Donor Advised Fund?

Your DAF can serve as your “clearing house” and organizational hub for all your charitable gifts. Donate complex assets to your DAF that smaller non-profits may not have the capacity to accept. The online donor portal allows you to easily request new grants and keep track of all your previous contributions and grants. You can donate to many charities via your DAF, and during tax time, you will only need to keep track of one charitable gift receipt!

A DAF may advise grants for up to two lifetimes, creating a legacy of philanthropy within a family. A DAF is a great tool for getting started on conversations with your family about giving back and gratitude.

Quick Facts

- Minimum Grant: $250

- Annual Fee: 1%, measured and paid as 0.25% quarterly

- May grant to non-profits across the United States

- May grant to non-Catholic organizations that are aligned with Catholic Social Teaching

“When we were looking to expand our charitable giving, a Donor Advised Fund appealed to us because of the convenience of giving and the opportunities for grant-making that matched our philanthropic interests. We have learned about deserving causes and programs through the helpful communications from the Foundation.”

GIVE to charities across the United States (Catholic and non-Catholic organizations)

BUNCH donations strategically for tax savings

GROW your money tax-free

SIMPLIFY your giving from one place – that means one gift receipt for your records!

Our core value is in providing donors the opportunity to advise grants in their key areas of interest. Commercial funds lack our personal touch and focus on a charitable mission. We connect donors with other individuals with similar interests and provide educational opportunities to enhance donors’ giving experience and efficacy.

As an active grant maker to the local community, we are well equipped to advise you on effective ministries, programs, and organizations that would benefit from your support. Donor Advised Funds with the Foundation can grant to any qualified 501(c)3 public charity as long as the organization engages only in work that aligns with Catholic social teachings.

What Do You Get with a CCF DAF?

- High-touch: Staff is available to assist donors with granting, fund management and deeper discussions about philanthropy.

- High-tech: Online portal allows grants to be made completely online and access to fund balances, grant history, gift history & database of grantees at any time.

- All funds are managed under Catholic guidelines for socially responsible investing. Learn more about our investments >>

“I highly suggest you set up a Donor Advised Fund with the Catholic Community Foundation. The support and guidance the Foundation has provided me is fantastic. It’s nice to be able to donate through an organization that is aligned with the Catholic values of charity and service.”

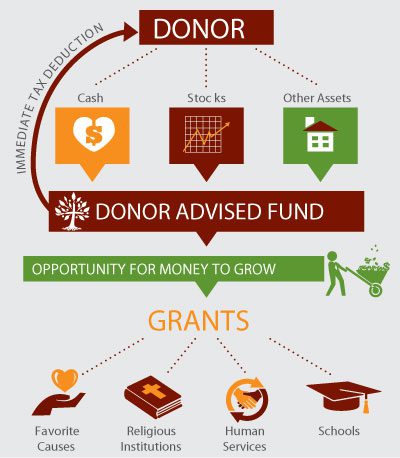

How Does it Work?

- You make a donation to your Donor Advised Fund. This donation is completely tax deductable in the year you make the gift.

- You choose an investment pool for your fund so your donations have the opportunity to grow.

- When you’re ready, you may advise grants to charities throughout the United States. There is no time limit/restriction for when you must make grants. Grant requests can be made through the online portal or by contacting the Grants Program Manager.

- You may add to your fund or grant all the money in the fund at any time.

Fees and Minimums

1% = annual fee which helps fund the Foundation’s mission and impact on our local community

$250 = minimum grant amount

Which Organizations Can I Give to Using my DAF?

- operating in the United States

- Catholic

- Non-Catholic and don’t conduct activities which go against Catholic Social Teaching

- Many of our DAF Holders use their fund to donate to their alma mater, non-denominational service organizations, environmental organizations and more.

Our Grants Program Manager ensures that all your grant checks are delivered to valid nonprofit organizations.

What Can I Donate to my DAF?

- Cash (checks, credit cards, EFTs – donate online here >)

- Stock (download our stock transfer form > and notify the Foundation before sending securities)

- Cryptocurrency (notify the Foundation before donating crypto)

- Real Estate and other real property (contact the Foundation > to discuss donating real property)

One of the great benefits of a DAF is the ability to donate complex assets and use the proceeds to support smaller organizations that may not have the capability to accept such gifts.

What is the Minimum Grant Amount from a DAF?

There is no limit on the number of grants you may advise from your fund.

What Services Does the Foundaiton Provide?

- Individualized customer service and recommendations of organizations for granting based on your interests

- The online portal allows you access to fund balances, grant history, gift history, & database of grantees

- Grant checks will be mailed within 30 days of the request

- No limit on the number of grants a donor can recommend

Ideas for using your Donor Advised Fund

Bunching with a Donor Advised Fund

What is “bunching” and how can it be beneficial for your taxes?

Responsive vs. Strategic Grantmaking

Do you know the difference between responsive and strategic grantmaking? Do you know which is best for your giving?

Most of the conversation around these topics is usually focused on foundations or major donors, however taking a critical look at how you give can be helpful for donors of all giving levels.