2024 Panel Discussion Recording

Tuesday, October 29, 2024

7:30 am – 9:00 am

7:30 – 8:15 am – Breakfast & Networking

8:15 – 9:00 am – Panel Discussion & Q&A

Silicon Valley Capital Club

50 W San Fernando St, San Jose, CA 95113

Don’t miss next year’s event!

Sign up for CCF’s Advisor E-Newsletter and receive the latest updates about this event and other news about philanthropy.

2024 Event Topic: Family Charitable Giving: Advisors’ and Donor’s Perspectives

This year’s Capstone Advisor Session panel features a panel of experienced advisors who will share stories from their first-hand experience as well as a donor who is currently working with his advisors on his philanthropic plans.

The panel will explore themes around multi-generational planning, trends in philanthropy planning, the advisor’s role, and more. Come hear their stories, insights and solutions and leave with new ideas and tools you can use with your own clients.

Sponsors

This event would not be possible without our generous sponsors.

Who Should Attend?

Professionals of all levels in the following fields:

- Estate Planning

- Tax

- Wealth Management

- Insurance

- Other advisory fields that work with individuals/families

Speakers

Darin Donovan

Partner, Lathrop GPM

Darin Donovan is a member of Lathrop’s (formerly Hopkins & Carley) Family Wealth & Tax Planning Practice. He practices in all areas of estate planning and wealth management. Darin’s clients include high net worth individuals and families, small business owners, private foundations and charitable non-profits, and executives and venture capitalists in the tech sector. He is also a Family Wealth Management Adjunct Professor at the Santa Clara University School of Law, Board Member of the Silicon Valley Chapter of the Society for Trust and Estate Practitioners (STEP), and Advisor & Former Board Member for The Peninsula School in Menlo Park.

Anne Macdonald

Tax Partner, Frank, Rimmerman + Co.

Anne specializes in financial planning to minimize income, gift, and estate tax for high-net-worth individuals and their families and has over 30 years of experience in public accounting. Her in-depth knowledge of estate planning is drawn from her extensive experience with family-limited partnerships, defective grantor trusts, charitable remainder trusts, and other wealth preservation techniques. Anne also provides concentrated stock and stock option planning as well as advises real estate entities on matters such as entity formations, sales, and like-kind exchanges. Her clients include CEOs and officers of public and pre-IPO companies, real estate owners, venture capitalists and other entrepreneurs and their families.

René Ho

Fund Holder at the Catholic Community Foundation

René is Chief Financial Officer for Taulia LLC, a subsidiary of SAP. René oversees the product, engineering, services, customer success, operations and administration of the company. He has also held senior roles at Visa in the United States and Asia.

René is currently Chair of the Finance Council at Catholic Community @ Stanford (CC@S) and previously was a catechist for the 3-5 year old children for the Catechesis of the Good Shepherd program at CC@S. René has also worked with Goodwill of Silicon Valley working with adults with autism, helping them find meaning and fulfillment through employment. René and his wife, Amy, have 2 teenage children at Sacred Heart Schools in Atherton.

Moderator

Mary Quilici Aumack

Chief Executive Officer @ The Catholic Community Foundation

Mary Quilici Aumack is the Chief Executive Officer of the Catholic Community Foundation where she has helped further the Foundation’s mission of creating FOREVER VALUE for the past 10 years. Prior to joining the foundation, Mary’s career was in high tech, including Vice President for Hewlett Packard, where she managed a $1Billion Enterprise Distribution business. Mary has a strong background in philanthropy. She is a former board member and current emeritus board member of Catholic Charities of Santa Clara County. She is a member of the Board of Fellows of Santa Clara University.

Frequently Asked Questions

How do I know if the content will be relevant to me? Is anyone allowed to attend this event?

Can I invite other people to this event?

How much do tickets cost?

Do I need my ticket handy to enter the event?

How can I become a sponsor for this event?

Will this event be livestreamed?

Highlights from Previous Years

Expanding the Definition of Philanthropy

On June 15, 2023, advisors from around the Bay Area gathered in San Jose to hear from a panel of experts about how philanthropy is changing and expanding. The panel examined how advisors can support clients as they explore philanthropic options and open the conversation to new ideas for giving.

A Conversation with 3 Generations of the Sobrato Family

On May 19, 2022, Capstone Advisor Session featured a conversation with three generations of the Sobrato family – John A., John M. and John Matthew Sobrato. They discussed the roots of their philanthropy, how they engage the younger generation, the future of the Sobrato Organization, how they think about impact, and more.

On May 19, 2022, Capstone Advisor Session featured a conversation with three generations of the Sobrato family – John A., John M. and John Matthew Sobrato. They discussed the roots of their philanthropy, how they engage the younger generation, the future of the Sobrato Organization, how they think about impact, and more.

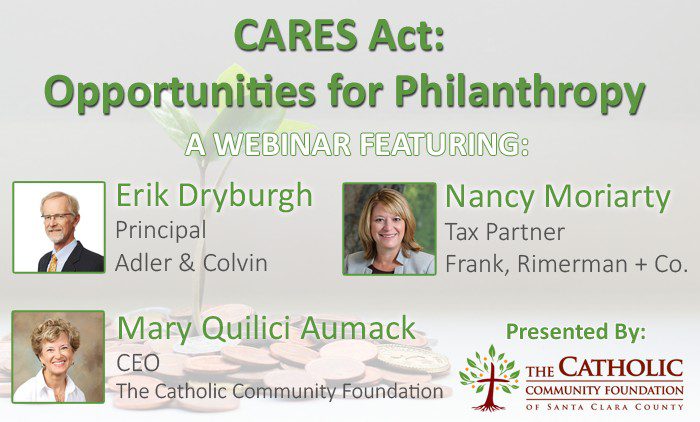

CARES Act: Tax Implications and Philanthropy Webinar

In 2020, the Foundation hosted a webinar exploring the tax implications of the CARES Act and how the legislation created opportunity for endowment as a solution for fulfilling philanthropic goals.

Nancy Moriarty, Tax partner at Frank, Rimerman + Co., spoke about the provisions of the legislation that impact philanthropy, and Erik Dryburgh, Principal at Adler & Colvin, discussed endowments, broadly and in light of this legislation. Mary Quilici Aumack, CEO of the Catholic Community Foundation, spoke about family endowments as a unique and effective way that families can take full advantage of this legislation while creating long-term financial support for organizations they love.

Philanthropy Planning with your Clients

Kia Sullivan, Vice President and Senior Philanthropic Advisor at Wells Fargo Bank and Anne M. Yamamoto, Senior Tax Partner at Frank, Rimerman + Co. LLP shared ideas – from complex to simple – about tax efficient ways to support clients in their desire to improve their communities and leave a legacy of generosity.

Kia Sullivan, Vice President and Senior Philanthropic Advisor at Wells Fargo Bank and Anne M. Yamamoto, Senior Tax Partner at Frank, Rimerman + Co. LLP shared ideas – from complex to simple – about tax efficient ways to support clients in their desire to improve their communities and leave a legacy of generosity.

What is the role of a financial or legal advisor in their clients’ philanthropic decisions? What is the context in which advisors are having these conversations in the Silicon Valley?presents on this topic at the Catholic Community Foundation’s “Advisor Breakfast: Philanthropy Planning with your Clients” on May 8, 2019.

On April 25, 2018, Bryan Polster, Chairman of the Board of Partners at Frank, Rimerman + Co. LLP, brought his years of expertise to the discussion of multigenerational tax planning and the new tax legislation. He touched on a wide variety ways advisors can maximize the effectiveness of existing tax strategies in light of the new legislation, including Donor Advised Fund bunching, IRA rollovers, family endowments, and charitable lead trusts.

On April 25, 2018, Bryan Polster, Chairman of the Board of Partners at Frank, Rimerman + Co. LLP, brought his years of expertise to the discussion of multigenerational tax planning and the new tax legislation. He touched on a wide variety ways advisors can maximize the effectiveness of existing tax strategies in light of the new legislation, including Donor Advised Fund bunching, IRA rollovers, family endowments, and charitable lead trusts.

Bryan described many techniques advisors can utilize to help their clients, but the true takeaway was his message about how advisors can use their role as influencer to help bridge the huge gap between poverty and wealth in our local community. The Giving Code*, a 2016 study of wealth and philanthropy in the Silicon Valley, notes that there are more than 12,550 households with over $5 million in investable assets, while in that same area 30% of people rely on social support to make ends meet. Along with the huge amount of wealth in the Valley, there is a real desire to give back, but donors, many of them young people with newly acquired wealth, don’t always know where or how to give.

According to an update to the The Giving Code in January of 2018, a common theme from the surveyed group of wealthy individuals was a frustration with their advisors. The advisors did a great job with technical recommendations or the “how” of philanthropic giving, but were lacking the “why.” Bryan encouraged everyone to not restrict themselves to the technical aspects of their position, but to draw upon and share their personal experiences with their clients when appropriate. Simple, honest conversations with clients can have a lasting impact and provide inspiration for their philanthropy.

Being this type of influencer in a client’s life is a calling and a challenge which requires awareness and collaboration. Bryan challenged everyone to collaborate more with their peers in their field and across fields to meet this need. By working together and partnering with organizations like the Foundation, advisors can help their clients identify, visualize, and articulate their objectives, and then make them into a reality. “Only with humility and an open mind,” said Bryan, “can we effectively collaborate with one another to benefit both our clients and our community.”

*Cortes Culwell, A. and McLeod Grant, H. (2016). The Giving Code: Silicon Valley Nonprofits and Philanthropy Executive Summary. [online] Open Impact LLC. Available at: https://static1.squarespace.com/static/579ea07b414fb51257607b72/t/580e9bf06b8f5b70e606d390/1477352433730/GivingCode_execsummary_download_102516.pdf [Accessed 7 May 2018].

The Capstone Advisor Session is the Foundation’s annual event for professional advisors where we aim to

equip professionals with new ideas and tools related to philanthropy and inspire professionals to have the conversation of philanthropy with their clients. The target audience is professionals in the fields of estate planning, tax accounting, wealth management, and other related professions.