Why Bunching Donations Today Makes Sense for Tomorrow

What is Bunching?

“Bunching” is when you combine multiple years of your “normal” charitable donations into a single year. For example, a person who normally gives $10,000 a year to charity would “bunch” two years’ worth of donations into a single year; meaning they would give $20,000 to charity one year and $0 to charity the next.

Why Bunch my Donations?

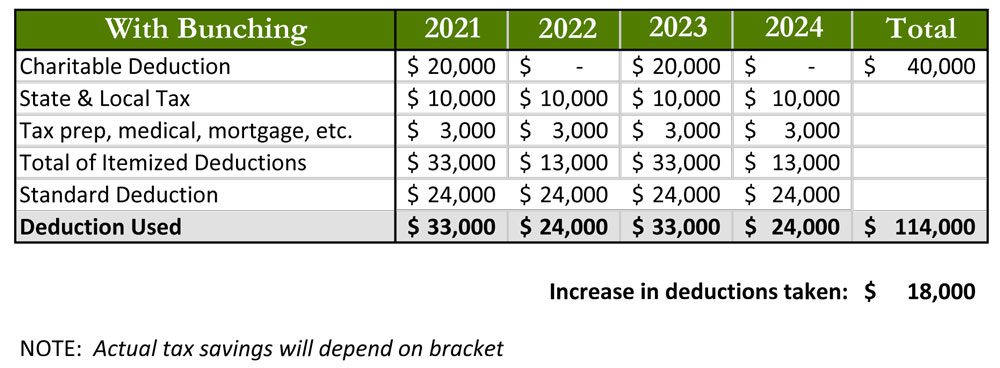

Bunching your donations means that during the year you donate to charity, your charitable deduction combines with other itemized deductions to increase the likelihood of exceeding the standard deduction. Your available tax deduction can actually increase if you use bunching, as you can see in the four-year bunching comparison below.

An Example

To illustrate the tax savings that may occur when a donor utilizes bunching, here is a four-year comparison of the Lee family’s deductions. The Lees give $10,000 to their Donor Advised Fund and distribute that money to the charities they love. They don’t anticipate any major changes in their finances in the next four years, so they are planning to utilize the standard deduction of $24,000, for a total of $96,000 over four years.

The next example shows the Lees bunching their donations to their Donor Advised Fund into two years instead of evenly spread across all four. Everything else stays the same, and they take the standard deduction in the years they don’t donate.

Why Bunch with a DAF?

While simply making all your donations in one year will get you the tax benefit, it can cause volatility in the charities you support. They will receive surpluses and shortfalls in bunching and non-bunching years, making it much more difficult for them to accurately budget and fundraise.

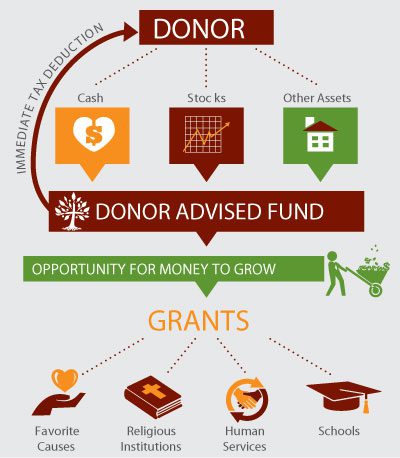

The solution for both taxpayers and charities is a Donor Advised Fund. This allows you to receive the full tax benefit of bunching, but also gives you the time and flexibility to advise grants to multiple charities with no time limit instead of giving in one lump sum. A Donor Advised Fund functions like a “charitable checking account.” You receive the tax deduction when you add money to the fund because that money can only ever be granted to nonprofit organizations. Your money grows tax-free in your fund and you don’t have a time limit for when you need to spend the money.

Why a DAF with the Catholic Community Foundation?

Our core value is in providing donors the opportunity to advise grants in their key areas of interest. Commercial funds lack our personal touch and focus on a charitable mission. We connect donors with other individuals with similar interests and provide educational opportunities to enhance donors’ giving experience and efficacy.

As an active grant maker to the local community, we are well equipped to advise you on effective ministries, programs, and organizations that would benefit from your support. Donor Advised Funds with the Foundation can grant to any qualified 501(c)3 public charity as long as the organization engages only in work that aligns with Catholic social teachings.

What Do You Get with a CCF DAF?

- High-touch: Staff is available to assist donors with granting, fund management and deeper discussions about philanthropy.

- High-tech: Online portal allows grants to be made completely online and access to fund balances, grant history, gift history & database of grantees at any time.

- All funds are managed under Catholic guidelines for socially responsible investing. Learn more about our investments >>

DAF Quick Facts

- Minimum to Open a DAF: $5,000

- Minimum Grant: $250

- Annual Fee: 1%, measured and paid as 0.25% quarterly

- May grant to non-profits across the United States

- May grant to non-Catholic organizations that are aligned with Catholic Social Teaching

“When we were looking to expand our charitable giving, a Donor Advised Fund appealed to us because of the convenience of giving and the opportunities for grant-making that matched our philanthropic interests. We have learned about deserving causes and programs through the helpful communications from the Foundation.”

How Does it Work?

- You make a donation to your Donor Advised Fund. This donation is completely tax deductable in the year you make the gift.

- You choose an investment pool for your fund so your donations have the opportunity to grow.

- When you’re ready, you may advise grants to charities throughout the United States. There is no time limit/restriction for when you must make grants. Grant requests can be made through the online portal or by contacting the Grants Program Manager.

- You may add to your fund or grant all the money in the fund at any time.

Fees and Minimums

1% = annual fee which helps fund the Foundation’s mission and impact on our local community

$250 = minimum grant amount

Which Organizations Can I Give to Using my DAF?

- operating in the United States

- Catholic

- Non-Catholic and don’t conduct activities which go against Catholic Social Teaching

- Many of our DAF Holders use their fund to donate to their alma mater, non-denominational service organizations, environmental organizations and more.

Our Grants Program Manager ensures that all your grant checks are delivered to valid nonprofit organizations.

What Can I Donate to my DAF?

- Cash (checks, credit cards, EFTs – donate online here >)

- Stock (download our stock transfer form > and notify the Foundation before sending securities)

- Cryptocurrency (notify the Foundation before donating crypto)

- Real Estate and other real property (contact the Foundation > to discuss donating real property)

One of the great benefits of a DAF is the ability to donate complex assets and use the proceeds to support smaller organizations that may not have the capability to accept such gifts.

What is the Minimum Grant Amount from a DAF?

There is no limit on the number of grants you may advise from your fund.

What Services Does the Foundaiton Provide?

- Individualized customer service and recommendations of organizations for granting based on your interests

- The online portal allows you access to fund balances, grant history, gift history, & database of grantees

- Grant checks will be mailed within 30 days of the request

- No limit on the number of grants a donor can recommend

Questions?

Please reach out to us with any questions regarding our fund or the services that we can provide.