Why Open a Donor Advised Fund?

Do you give to charity regularly?

Do you want to simplify your giving?

Are you interested in maximizing strategic tax savings?

If you answered yes to any (or all) of these questions, a Donor Advised Fund at the Foundation might be a great fit for you!

Opening a fund is simple and may take as little as a few days!

Open a fund today by filling out our Donor Advised Fund Agreement Form and sending your initial deposit

Questions?

Benefits of a DAF

GIVE to charities across the United States (Catholic and non-Catholic organizations)

BUNCH donations strategically for tax savings

GROW your money tax-free

SIMPLIFY your giving from one place – that means one gift receipt for your records!

↓ Click for more information about Donor Advised Funds (DAFs) ↓

What is a Donor Advised Fund?

A Donor Advised Fund (DAF) is a tax-advantaged, convenient vehicle for donating to all the organizations you already love. You receive the full tax deduction in the year that the contribution is made to your DAF, and you can take your time in deciding when and to whom you would like to advise grants.

A DAF may advise grants for up to two lifetimes, creating a legacy of philanthropy within a family. The investments will grow tax-free for future grants to charitable causes. In the case of appreciated assets, a Donor Advised Fund can assist you in turning capital gains into charitable gains!

“I highly suggest you set up a Donor Advised Fund with the Catholic Community Foundation. The process of setting up a DAF was easy and the support and guidance the Foundation has provided me is fantastic. It’s nice to be able to donate through an organization that is aligned with the Catholic values of charity and service.”

Our core value is in providing donors the opportunity to advise grants in their key areas of interest.

Commercial funds lack our personal touch and focus on a charitable mission. We connect donors with similar interests and provide educational opportunities to enhance donors’ giving experience and efficacy.

As an active grant maker to the local community, we are well equipped to advise you about effective programs and organizations that would benefit from your support. Donor Advised Funds with the Foundation can grant to any qualified 501(c)3 as long as the charitable organization

engages only in work that aligns with Catholic social teachings. All of the Foundation’s funds are managed under Catholic guidelines for socially responsible investing.

“When we were looking to expand our charitable giving, a Donor Advised Fund appealed to us because of the convenience of giving and the opportunities for grant-making that matched our philanthropic interests. We have also learned about deserving causes and programs through the helpful communications from the Foundation.”

How Does it Work?

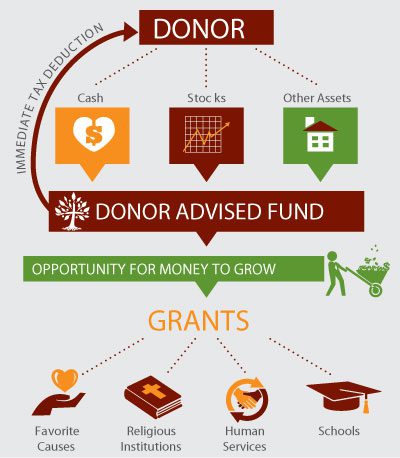

- You make a donation to open a Donor Advised Fund. This donation is completely tax deductable in the year you make the gift.

- You choose an investment pool for your fund so your donation has the opportunity to grow.

- When you are ready, you may advise grants to nonprofits throughout the United States. There is no time limit/restriction for when you must make grants. Grant requests can be made through the online portal or by contacting the Grants Program Manager.

- You may add to your fund or spend all the money in the fund at any time.

Fees and Minimums

$10,000 = minimum to start a Donor Advised Fund

1% = annual fee which helps fund the Foundation’s mission and impact on our local community

Which Organizations Can I Give to Using my DAF?

Donor Advised Funds at the Foundation can grant to 501(c)3 nonprofit organizations which are:

- operating in the United States

- Catholic

- Non-Catholic and don’t conduct activities which go against Catholic Social Teaching

- Many of our DAF Holders use their fund to donate to their alma mater, non-denominational service organizations, environmental organizations and more.

Our Grants Program Manager ensures that all your grant checks are delivered to valid nonprofit organizations.

What Can I Donate to Open a DAF?

The Foundation accepts all kinds of assets including

- Cash (checks, credit cards, EFTs – donate online here >)

- Stock (download our stock transfer form > and notify the Foundation before sending securities)

- Cryptocurrency (notify the Foundation before donating crypto)

- Real Estate and other real property (contact the Foundation > to discuss donating real property)

One of the great benefits of a DAF is the ability to donate complex assets and use the proceeds to support smaller organizations that may not have the capability to accept such gifts!

What is the Minimum Grant Amount from a DAF?

The minimum amount for any individual grant is $250.

There is no limit on the number of grants you may advise from your fund.

What Services Does the Foundaiton Provide?

- Individualized customer service and recommendations of organizations for granting based on your interests

- Online portal allows access to fund balances, grant history, gift history, & database of grantees

- Grant checks will be mailed within 30 days of the request

- No limit on the number of grants a donor can recommend

Ideas for using a Donor Advised Fund

Bunching with a Donor Advised Fund

What is “bunching” and how can it be beneficial for your taxes?

Gifted and Testamentary DAFs

Would you like to give someone the gift of charitable giving? Would you like to include a DAF as part of your estate plan? We can help!