Though tax incentives are rarely the only reason donors make gifts (see this article), bunching is a strategy which allows donors to continue giving to charities they love and capture tax savings in light of the new federal standard deduction.

Though tax incentives are rarely the only reason donors make gifts (see this article), bunching is a strategy which allows donors to continue giving to charities they love and capture tax savings in light of the new federal standard deduction.If you would like to know more about how bunching can benefit your clients, see the comparison below showing the difference in a family’s deduction between bunching and not bunching over four years.

Bunching: Definition & Description

The Tax Advisor website describes bunching as when taxpayers “combine multiple years of ‘normal’ annual charitable contributions into a single year.” During the years in which bunching occurs, the charitable deduction combines with other itemized deductions to increase the likelihood of the taxpayer exceeding the standard deduction.

Bunching donations directly to charities gives the donor the tax benefits, but may cause greater volatility for the charity’s revenue stream. They may receive surpluses and shortfalls in bunching and non-bunching years from their donors, making it much more difficult for them to accurately budget and fundraise.

The solution for both taxpayers and charities is a Donor Advised Fund. This allows the taxpayer to receive the full tax benefit of bunching, but also gives them time to advise grants to multiple charities from their fund gradually instead of in one lump sum. To learn more about our Donor Advised Funds, visit cfoscc.org/donor-advised-funds

An Example

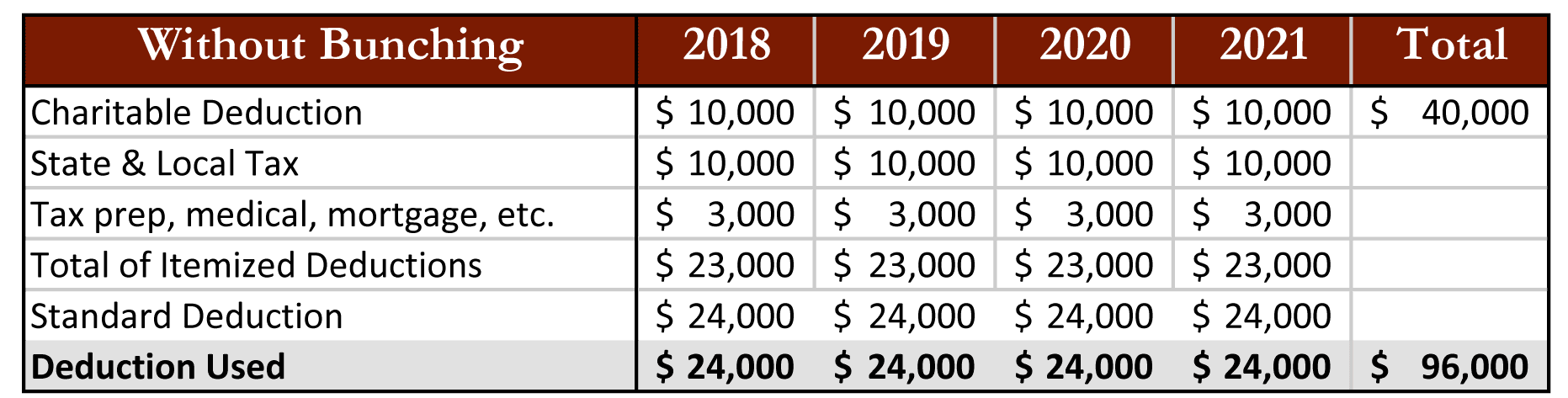

To illustrate the tax savings that may occur when a donor utilizes bunching, we show a four-year comparison of the Lee family’s deductions. The Lees give $10,000 to their Donor Advised Fund and distribute that money to the charities they love. They don’t anticipate any major changes in their finances in the next four years, so they are planning to utilize the standard deduction of $24,000, for a total of $96,000 over four years.

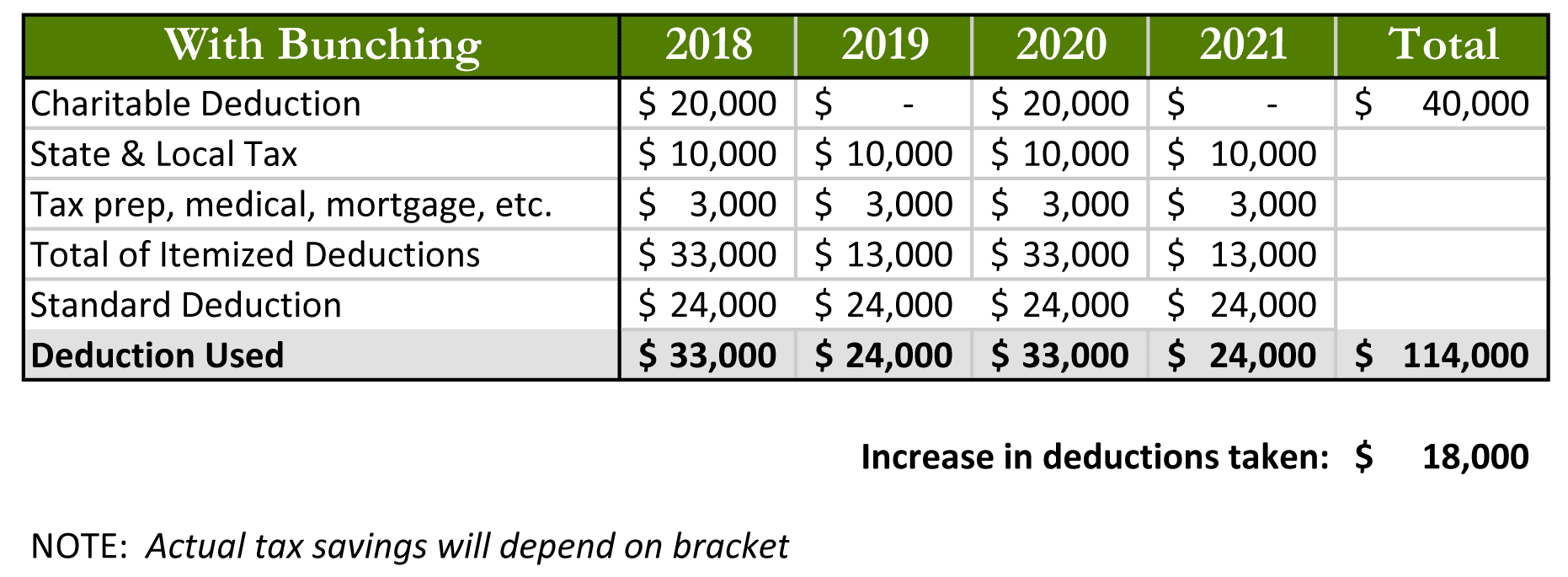

The next example shows the Lees bunching their donations to their Donor Advised Fund into two years instead of evenly spread across all four. Everything else stays the same, and they take the standard deduction in the years they don’t donate.

As you can see, they gave the same amount of money to charity in both scenarios ($40,000), but the tax deduction increases by $18,000 over four years if bunching is used.

If you are able to do so, the combination of a Donor Advised Fund and bunching can be a great strategy for optimizing your charitable deduction and continuing to support the charities you love.